Risk Planning

The Sobering Reality of Long Term Care Insurance

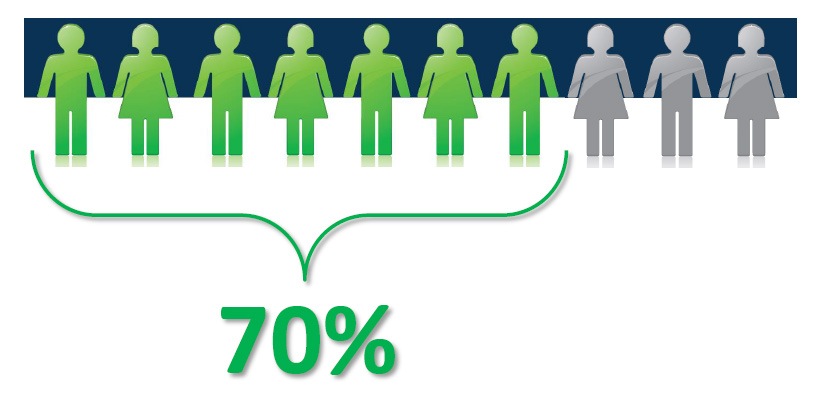

Fact: 70 percent of people over age 65 will need long term care

Fact: Medicare will only cover up to 100 days of treatment for short-term recovery

Long Term Care Insurance

Long term care insurance is more than just ordinary retirement planning. The goal of long term care insurance is to keep you out of a nursing home, maintain your independence at home, and protect your assets. It removes the worry of having to earmark your nest egg for the uncertainty of needing care, so you can enjoy doing the things that make you happy.

Longevity Increases Need.

Modern health technology is helping the average United States citizen live a longer life. This extended longevity is increasing the likelihood a person will need long term care services at some point during their life. In addition to Alzheimer’s and dementia, there are other degenerative diseases such as obesity, diabetes, stroke, heart problems, cancer, and Parkinson’s disease, as well as accidents and injuries resulting in conditions such as bone fractures, which may all create the need for long term care services. Long term care insurance can help pay for the cost of caring for those conditions so you will have peace of mind knowing you are protected if it were to happen to you.

What Does Long Term Care Insurance Pay For?

Your long term care insurance benefits can be used to pay for home health care, assisted living facilities, adult day care and nursing homes. In fact, 72% of all LTC claims are used to pay for home health care, a service that provides you with in-home help with your activities of daily living, as well as cooking and cleaning. Long Term Care Insurance will help ensure you will be able to stay in your own home to receive care.

Doesn’t it make sense to protect yourself from the greatest financial risk you will face in your retirement? Having long term care insurance coverage can save your nest egg and your retirement. Imagine how relaxed you’ll feel knowing that you planned ahead and now you and your family are protected. Contact one of our qualified Wexford financial advisors at Greg Miller & Associates today for the help you need planning for your future.